Liberate Liquidity

with Pachira

A unique DeFi primitive

A fully on‑chain decentralized ETF

Pachira introduces the Liquidity Tree Protocol: an ETF‑like system that issues a reserve‑backed liquidity unit and routes capital to where it earns the most. You get automation without losing transparency and a clear exit.

1) Join a Basket

Buy or mint the pool’s DETF token — it represents a basket of regular and/or LP tokens.

2) Bond for Index Exposure

Bond your DETF to receive the linked index token exposure/incentives.

3) Provide Liquidity (Optional)

Deposit LP or base assets (e.g., ETH/USDC). Receive a Bond NFT redeemable for a share of LP at maturity.

Who said money doesn’t grow on trees?

Most liquidity Pools

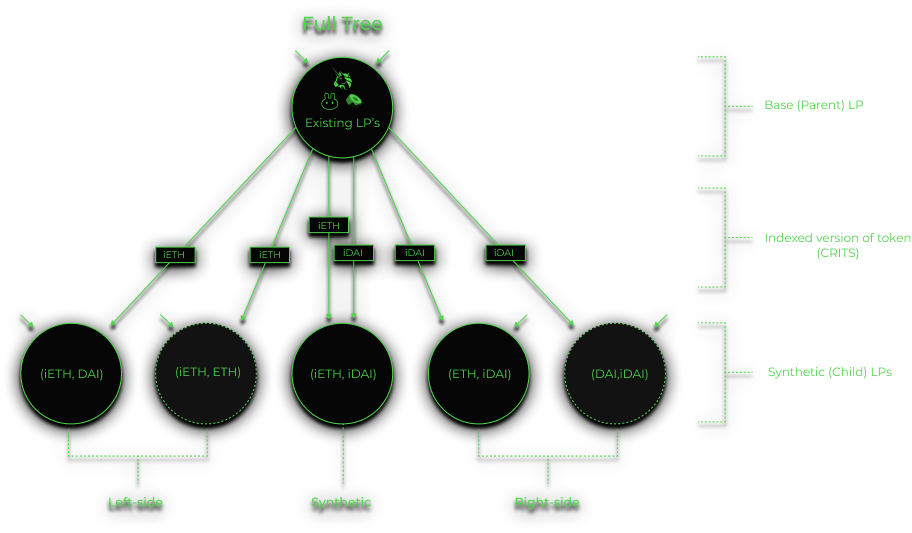

Liquidity Tree visualization

Liquidity Trees at work

Idle liquidity wakes up, Liquidity Trees route it where it’s needed, linking markets and igniting volume.

Moves in the Parent LP cascade into Indexed Pools, opening clean arbitrage lanes and nonstop trading.

That activity gets monetized Indexed Pools capture the flow through fees.

The Pachira Token Ecosystem

Liquidity unit (reserve‑backed)

- Mint/burn via the vault; tracks reserve/index value

- Escrow CHIR to receive revenue token

- Deposit assets or supported LP tokens to participate

Access (fixed supply)

- Direct path to the revenue token—no escrow

- Clean exposure to protocol fee growth

- Complements CHIR’s liquidity role

Revenue + index

- Receives protocol fees from Liquidity Trees

- Indexes CHIR; shared destination of both lanes

- Holders see transparent distributions

Proudly associated with leading DeFi protocols as partners and integrators.

Partners

Integrations

Don’t Miss on Value

Find value, your way.

Active traders

Trade, move liquidity between pools, and earn from price gaps.

Projects & communities

Create your own pools and market setup to support your token.

Yield seekers

Deposit once and earn yield from fees and rewards, hands-off.

Long-term investors

Lock longer for higher potential returns and steady growth.

Roadmap

Q3

Test Net Launch

DETF token creation

$RICH Token Launch

Audit

Mainnet Launch

Integration of Uni v3, v4 pools

Q1

Integration of more pool types for enhanced composability

Launch Pachira Strategy Suite

Q2

Lending backed DETFs

Volatility Perp Dex

Meet The Team

Pachira is backed by a team of industry veterans who have been at the bleeding edge of decentalized technology, collaborating with leaders in the space.

Alex Guerra

Co founder & Head of Business

Alex has been a key partner in growing crypto ecosystems, with experience in growing ecosystems for a range of crypto products, protocols, and advancements.

A recent highlight of his crypto development includes expanding the ecosystem supporting the Bitcoin-backed layer-2 protocol Rollux.

Cyotee Doge

Co founder and lead developer

Cyotee Doge leads the engineering function at Pachira after having been the main architect of the Olympus DAO. Now responsible for the technical execution of the Pachira Liquidity Tree Protocol and integrating it with various blockchain ecosystems.

Patrick Breaux

Head of marketing

Patrick brings the team over half a decade of spearheading crypto marketing for projects ranging from layer-1 and layer-2 protocols to NFT marketplaces.

His background in multimedia gives him a key foot insight into trends and identifying and building relationships with community leaders.

Alex Priadko

Full Stack Developer

Years of web development and smart contracts.

Zak Cole

Advisor

Web3 Engineer & Entrepreneur.

Andre Fialho

Crypto-native Developer

Andre Fialho is a Crypto-native developer with a background in smart contracts and data analytics.